Budgeting app

Overview:

The purpose of this study was to understand how people budget their money. This study was in 3 phases consisting of a Focus Group, a Survey, and a Diary Study.

The hypothesis stands that people can take control of their money by tracking how, when and what they spend it on.

Roles:

Moderator: Focus Group

Researcher: Focus Group, Survey, Diary Study

Designer: Wire frames/High-Fidelity

Timeline

January

April

Problem

People have trouble reaching their saving goals.

Hypothesis

People can take control of their money by tracking how, when and what they spend it on.

METHODS

1. Focus Group

Goal

Understand people's patterns and attitudes towards spending habits.

Role as Moderator

Led a 30 minute discussion with 4 participants.

Kept track of time.

Encourage participation.

Activity

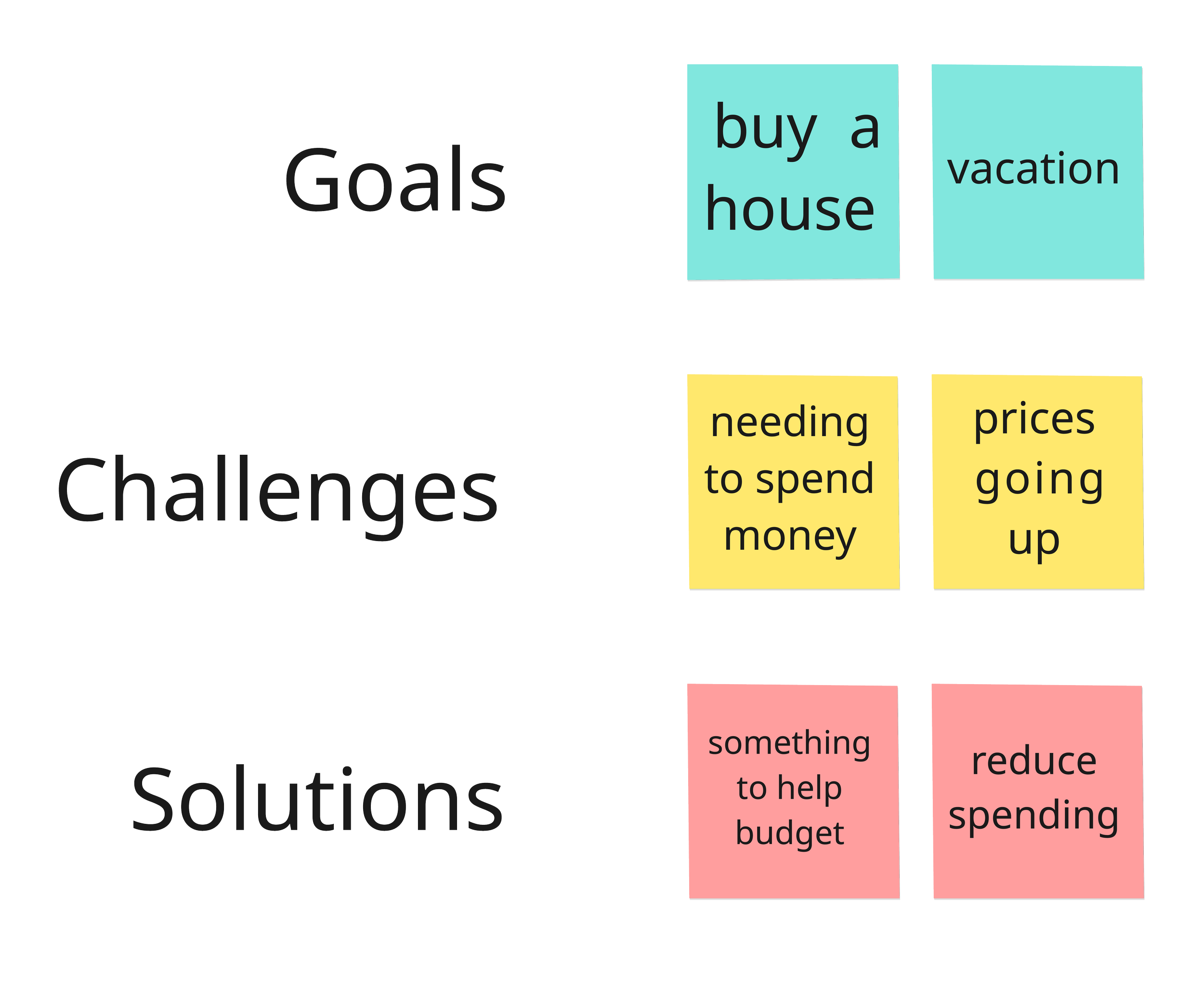

Participants were asked 3 questions. For each question they would write their answer(s) on a sticky notes.

Participants were wrote down long-term and/or short-term goals and placed them on the white board along the first row.

Participants wrote down challenges for spending and saving and placed them on the middle row on the white board.

Participants wrote down solutions for spending and saving and placed them on the last row on the white board.

Findings

People have a variety of different Goals they want to save for.

People felt guilty about spending.

People need help to budget, reduce spending and increase savings.

2. survey

Role as Researcher

Create 12 question survey on Google Forms.

Recruit and screen participants.

Analyze survey results.

Goal

The goal was to learn about the frequency and the ways people spend and budget their money.

ACtivity

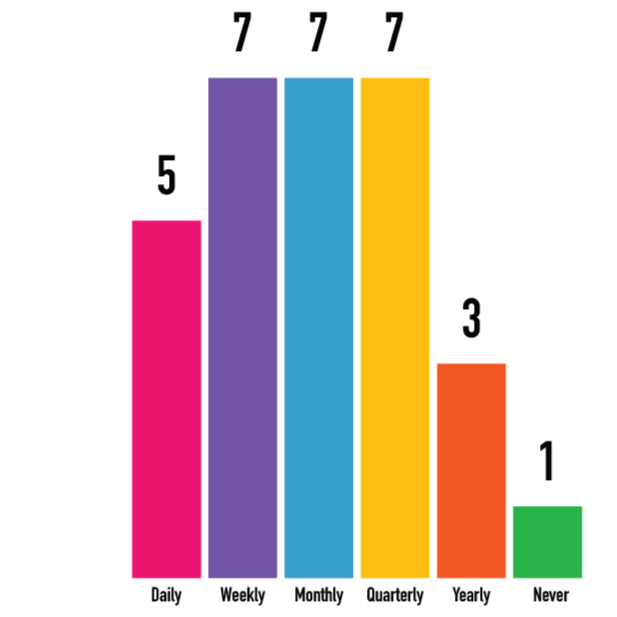

Q4. How often do you feel guilty about your spending habits?

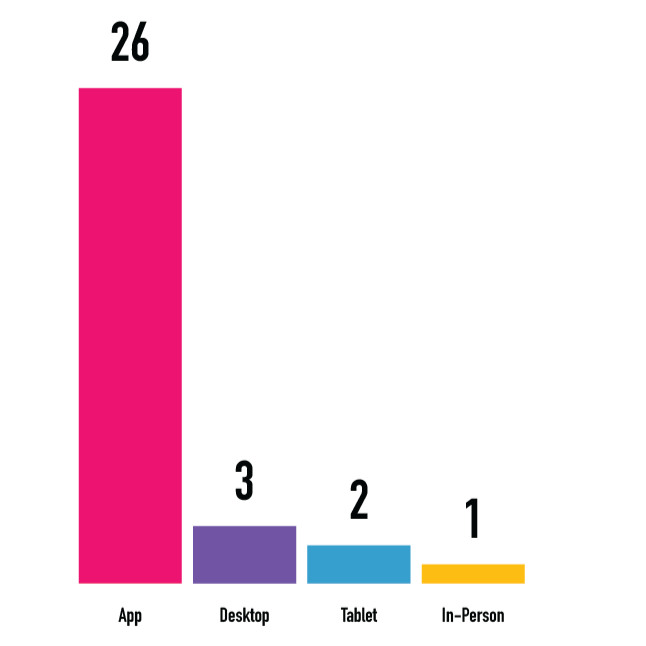

Q6. Select the type of banking you use the most.

Q9. Rate which features are most important to you in a banking app.

Findings

Most people feel guilty about their spending.

(From Q4)The primary focus for this product should be a mobile app.

(From Q6)Spending limits and saving goals should be main features to focus on.

(From Q9)

3. Diary Study

Goal

Learn how people actually spend and budget their money everyday, for a 10 day period.

Role as Researcher

Create Diary activity.

Remind participants to complete diary entry.

Interview participants at end

Analyze diary results.

Activity

Participants for this Diary study were told to track and record their spending over 10 Days.

On Day 1 participants were asked to report on how they planned to budget.

On Day 10 participants reflected on how they budgeted.

Findings

Participants are still using excel sheets, pen and paper, or bank statements to track expenses.

Participants realized how much they were actually spending when they started tracking.

Most participants have financial Goals they want to achieve.

Participants mentioned budgeting for categories like entertainment, food, clothes.

solutions

Make it easier for users to track their expenses in one place.

The home page shows the daily budget, daily savings and expenses.

Set a custom spending limit and alert that notifies the user when their close to their spending limit.

They can name and budget for categories

(food, entertainment, activities, clothes).

People have short term and long term saving goals.

A feature for users to add goals and track their progress.

Users can instantly see how much they saved.

They can see an overview of their spending habits from previous days and months.

Users can automatically track their expenses by scanning their receipt.